The Quantum Quandary: An Overview of Current Market Challenges

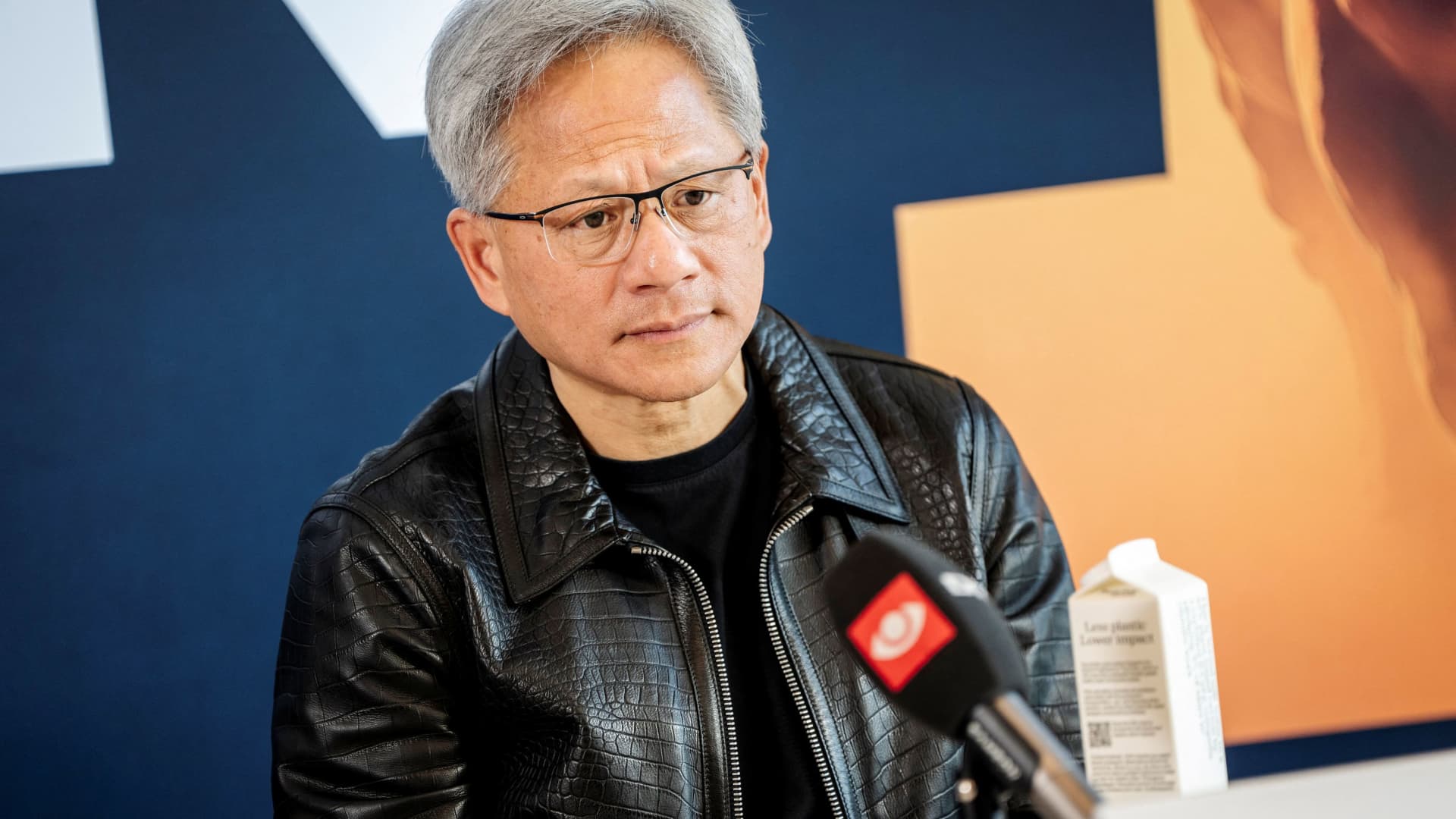

In recent months, the quantum computing sector has faced unexpected turbulence, with stocks of promising companies like Rigetti Computing experiencing significant declines. This downturn has raised eyebrows, especially in light of statements made by prominent industry leaders, such as Nvidia’s CEO, Jensen Huang. He recently pointed out that practical quantum computing technology is likely still decades away from realization. This declaration has prompted investors and analysts alike to reassess the immediate future of the quantum computing industry, leading to a broader discussion about the factors influencing these market dynamics.

Understanding the Quantum Computing Landscape

Quantum computing is often touted as the next frontier in technology, with the potential to revolutionize various fields, including cryptography, optimization, and drug discovery. Unlike classical computers, which process information in binary (0s and 1s), quantum computers utilize quantum bits, or qubits, allowing for much more complex computations. However, the technology is still in its infancy, and many challenges must be overcome before it can deliver on its promises.

Key Players and Their Innovations

Several key players in the quantum computing market, including Rigetti, IBM, Google, and D-Wave, have been at the forefront of research and development. Each company is pursuing unique approaches to quantum computing:

- Rigetti Computing: Focuses on developing quantum processors and a cloud platform, allowing developers to access quantum computing capabilities.

- IBM: Pioneering in quantum cloud computing with its IBM Quantum Experience, offering accessible quantum computing resources to researchers and developers.

- Google: Known for its significant achievements in quantum supremacy, showcasing the potential of quantum algorithms to outperform classical computations.

- D-Wave: Specializes in quantum annealing, a technique aimed at solving optimization problems efficiently.

Despite the impressive strides these companies have made, the commercial viability of quantum computing remains a hotly debated topic. Investors are often caught between optimism about future breakthroughs and the harsh reality of the current technological limitations.

The Impact of Market Sentiment on Quantum Stocks

The stock market is notoriously influenced by sentiment, and recent comments from influential figures, such as Jensen Huang, can have immediate repercussions. Huang’s assertion that practical quantum computers are decades away has instilled doubt among investors, leading to a sell-off in quantum stocks, including Rigetti. This sudden shift in sentiment can be attributed to several interconnected factors:

- Overhyped Expectations: The quantum computing sector has been characterized by a wave of excitement, with many investors expecting rapid advancements and quick returns. Huang’s comments have served as a reality check, highlighting the long road ahead.

- Financial Performance: Companies like Rigetti have faced scrutiny over their financial health and business models. As investors reassess the potential for profitability in the near term, stocks may be subject to volatility.

- Technological Hurdles: Quantum computing is fraught with technical challenges, including error rates in qubit operations, scalability issues, and the need for specialized environments to maintain qubit stability.

Regulatory and Economic Factors

Beyond technological considerations, broader economic and regulatory factors also play a role in shaping investor confidence. Inflationary pressures, rising interest rates, and concerns about a potential recession can lead investors to adopt a more cautious approach toward high-risk sectors like quantum computing. Furthermore, discussions around regulation of emerging technologies may add another layer of uncertainty, as companies navigate compliance while trying to innovate.

Resilience and Future Prospects

Despite recent setbacks, the future of quantum computing remains promising. The technology is poised to offer transformative solutions across various industries. For instance, companies are exploring applications in:

- Pharmaceuticals: Accelerating drug discovery through complex molecular simulations.

- Finance: Enhancing risk analysis and portfolio optimization.

- Logistics: Improving supply chain efficiencies through advanced optimization algorithms.

Moreover, as companies continue to invest in research and development, breakthroughs in quantum algorithms, error correction, and hardware design could pave the way for practical applications sooner than anticipated.

Strategies for Investors

For investors looking to navigate the quantum quandary, a balanced approach is essential. Here are some strategies to consider:

- Diversification: Instead of focusing solely on quantum computing stocks, consider building a diversified portfolio that includes other sectors and technologies.

- Long-Term Vision: Embrace a long-term investment perspective, understanding that technological advancements can take time to materialize.

- Staying Informed: Keep abreast of developments in the quantum computing space, including breakthroughs, partnerships, and regulatory changes that may impact the market.

Conclusion: Embracing the Quantum Future

The quantum quandary presents both challenges and opportunities for investors and stakeholders in the technology sector. While recent statements from industry leaders have raised concerns about the immediate future of quantum computing, it is crucial to recognize the potential that this transformative technology holds. As research continues and new innovations emerge, the market may stabilize and offer new avenues for growth.

Ultimately, patience and a willingness to adapt to the changing landscape of technology will be key for investors looking to capitalize on the long-term potential of quantum computing. The journey may be fraught with uncertainty, but the promise of quantum technology remains a beacon of hope for the future.

See more Future Tech Daily