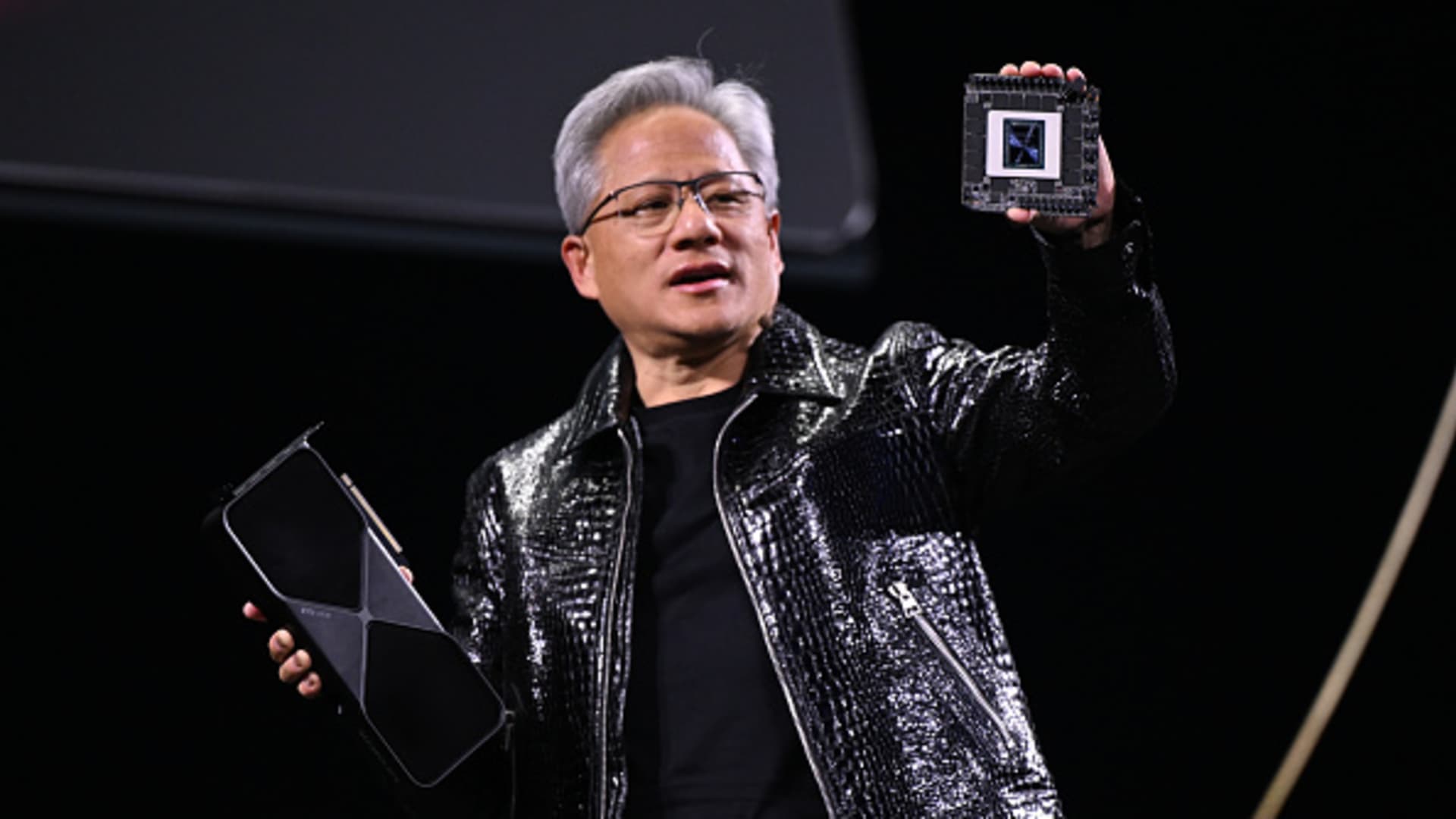

Nvidia’s Stock Dip: Understanding CEO Jensen Huang’s Bold AI Vision

In recent weeks, Nvidia’s shares have faced a significant downturn, prompting investors and analysts alike to reassess the company’s position in the rapidly evolving tech landscape. As the dust settles, CEO Jensen Huang is stepping into the spotlight with a bold vision for artificial intelligence (AI) that aims to redefine Nvidia’s trajectory. This article delves into the implications of Huang’s strategy, what it means for investors, and how it may shape the future of AI technology.

The Current State of Nvidia’s Stock

Nvidia has long been a dominant player in the semiconductor industry, particularly in graphics processing units (GPUs) that power everything from video games to data centers. However, the company’s stock has recently dipped, reflecting broader market trends and investor apprehensions. Factors contributing to this decline include:

- Market Volatility: Fluctuations in the stock market have affected tech stocks disproportionately, leading to a sell-off.

- Supply Chain Issues: Ongoing global supply chain disruptions have impacted production timelines and inventory levels.

- Profit-Taking: After a meteoric rise in stock prices over the past few years, some investors may be cashing in on their gains.

Despite these challenges, Huang remains optimistic about Nvidia’s future, particularly in the realm of AI. His vision could potentially turn the tide for the company’s stock and restore investor confidence.

Jensen Huang’s AI Vision

Jensen Huang, who co-founded Nvidia in 1993, is no stranger to innovation. His passion for AI has driven the company’s research and development initiatives, positioning Nvidia as a leader in the sector. Huang’s latest strategy revolves around expanding Nvidia’s AI capabilities, focusing on several key areas:

1. AI Infrastructure

Huang envisions Nvidia as the backbone of AI infrastructure, providing the necessary hardware and software for enterprises looking to adopt AI technologies. This includes enhancing GPU capabilities to support advanced machine learning and deep learning applications. By investing in AI infrastructure, Nvidia aims to:

- Increase the processing power needed for complex AI models.

- Enhance the efficiency of data centers handling AI workloads.

- Facilitate faster deployment of AI applications across various industries.

2. Strategic Partnerships

To bolster its AI initiatives, Nvidia is actively pursuing strategic partnerships with leading tech firms and research institutions. These collaborations are designed to:

- Accelerate the development of AI solutions.

- Expand Nvidia’s reach in various sectors, including healthcare, automotive, and finance.

- Leverage joint expertise to push the boundaries of AI research.

By forming alliances, Nvidia seeks to position itself as the go-to provider for AI solutions, ensuring that its technology remains at the forefront of innovation.

3. Focus on AI Ethics and Safety

As AI technology continues to evolve, ethical considerations have become increasingly important. Huang has emphasized the need for responsible AI development, advocating for:

- Transparency in AI algorithms to avoid biases.

- Implementing safety measures to prevent misuse of AI technologies.

- Collaboration with regulatory bodies to establish guidelines for AI deployment.

This focus on ethics not only enhances Nvidia’s reputation but also builds trust with investors and consumers, positioning the company as a leader in responsible AI innovation.

Implications for Investors

For investors, Huang’s bold AI vision presents both opportunities and risks. Here’s what to consider:

Opportunity for Growth

If Huang’s strategy is successful, Nvidia could see a resurgence in its stock prices fueled by increased demand for AI technologies. Key factors that could drive this growth include:

- Expanding Market: The global AI market is projected to reach trillions of dollars in the coming years, offering ample opportunity for Nvidia to capture market share.

- Innovative Products: Continued innovation in AI hardware and software can attract new customers and retain existing ones.

- Positive Industry Trends: As industries increasingly adopt AI solutions, Nvidia stands to benefit from being a leading provider.

Potential Risks

However, there are also risks that investors must consider:

- Market Competition: The AI landscape is becoming crowded, with competitors like AMD, Intel, and various startups vying for a piece of the pie.

- Regulatory Challenges: As governments around the world grapple with AI regulation, any adverse regulations could impact Nvidia’s operations.

- Economic Factors: Broader economic conditions, including inflation and interest rates, could affect consumer spending on technology.

Investors should carefully weigh these factors when considering their investment in Nvidia.

The Future of Artificial Intelligence

Looking ahead, Huang’s vision for AI could have far-reaching implications beyond just Nvidia. As AI technologies continue to advance, they hold the potential to:

- Revolutionize Industries: From healthcare to transportation, AI can transform how businesses operate, leading to increased efficiency and innovation.

- Enhance Daily Life: AI applications in smart homes and personal devices can improve convenience and quality of life for consumers.

- Drive Economic Growth: The proliferation of AI technology can create new jobs and boost productivity across sectors.

The trajectory of Nvidia under Jensen Huang’s leadership will likely play a pivotal role in shaping the future of AI. Investors who align themselves with this vision may find themselves at the forefront of a technological revolution.

Conclusion

While Nvidia’s stock dip raises questions about its immediate future, Jensen Huang’s bold AI vision presents a compelling narrative for long-term growth and innovation. By focusing on AI infrastructure, strategic partnerships, and ethical considerations, Nvidia stands poised to redefine its role in the tech landscape. As the company navigates the complexities of the market, investors must stay informed and consider the potential benefits and risks that Huang’s strategy entails. The future of artificial intelligence is bright, and Nvidia is determined to be a key player in this transformative journey.

See more Future Tech Daily