Nvidia CEO Challenges Misconceptions About AI: Understanding the DeepSeek Sell-Off

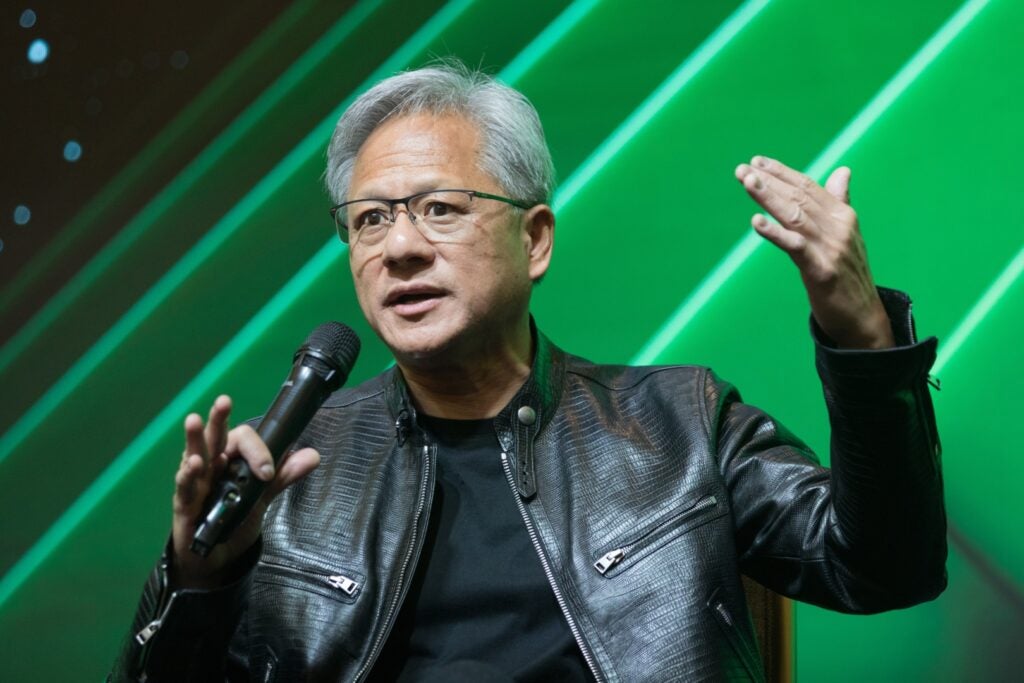

In a recent press conference, Nvidia’s CEO took a bold stance, confronting the prevailing misconceptions surrounding artificial intelligence (AI) that have contributed to the market’s recent fluctuations, particularly in relation to the DeepSeek sell-off. The CEO emphasized that many investors and analysts are misinterpreting crucial concepts like ‘post training’ and ‘inference,’ which are fundamental to understanding AI’s trajectory and its potential. This article explores the implications of these misconceptions, the reality of AI investment, and what the future may hold for this fast-evolving technology.

Defining the Terms: Post Training and Inference

To grasp the essence of the CEO’s argument, it’s essential to define ‘post training’ and ‘inference.’ In the realm of AI, particularly in deep learning, the training phase is where models learn from vast amounts of data. This phase is computationally intensive and requires significant resources, often involving powerful GPUs, like those Nvidia produces.

Once a model is trained, it enters the ‘post training’ phase. Here, the model’s performance can be evaluated, and adjustments are made based on its predictive accuracy. Inference, on the other hand, refers to the process of using the trained model to make predictions on new, unseen data. This phase is critical as it determines how the model performs in real-world applications.

However, the Nvidia CEO argued that the traditional understanding of these phases is flawed. Many believe that the complexity and resource demands of the post-training and inference phases suggest that AI is not as accessible or scalable as it could be. This notion has led to skepticism in the market, particularly regarding companies like DeepSeek, which recently faced a sell-off due to perceived underperformance.

The DeepSeek Sell-Off: A Misunderstood Event

DeepSeek, a company specializing in AI-driven analytics, saw its stock prices plummet following a series of disappointing earnings reports. Investors quickly linked this downturn to broader issues within the AI market, fearing that the complexities of post-training and inference were leading to stagnation.

However, Nvidia’s CEO pointed out that the challenges faced by DeepSeek are not indicative of the AI industry’s overall health. Instead, he suggested that such fluctuations are part of the natural evolution of technology adoption. Startups and tech companies often experience volatile market reactions as they scale their operations and refine their offerings.

- Market Overreaction: Investors often react swiftly to short-term performance metrics without understanding the underlying technology’s potential.

- Long-term Vision: AI technology is still in its infancy, and companies like DeepSeek are pioneering pathways that will eventually lead to more stable growth.

- Misalignment of Expectations: Many investors have unrealistic expectations regarding the speed at which AI can be developed and adopted.

Addressing Common Misconceptions

One of the significant challenges within the AI sector is the proliferation of misconceptions that lead to misinformed investment decisions. Here are some prevalent myths that the Nvidia CEO aimed to debunk:

- AI is a One-Size-Fits-All Solution: Many believe that AI can be seamlessly integrated into any business model. In reality, successful AI implementation requires tailored strategies and significant upfront investment.

- Post Training is a Minor Step: Some investors underestimate the complexity of the post-training phase. This phase is crucial for ensuring that AI models are robust and reliable.

- Inference is Immediate: The assumption that inference can happen instantaneously is misleading. It often requires ongoing optimization and resource allocation.

The Future of AI Investment

With the Nvidia CEO’s insights, it becomes clear that the future of AI investment hinges on a deeper understanding of the technology and its phases. As the market stabilizes, investors must adopt a long-term perspective focused on the potential of AI technologies rather than reacting to short-term volatility. Here are several key points to consider:

- Invest in Education: Investors should educate themselves about AI processes, understanding the nuances between training, post-training, and inference.

- Focus on Fundamentals: Evaluating companies based on their technological foundations and R&D capabilities will yield better investment insights.

- Embrace Innovation: The AI landscape is continually evolving; being open to new ideas and technologies can lead to identifying the next big opportunity.

Nvidia’s Role in Shaping AI’s Future

Nvidia plays a pivotal role in advancing AI technology, particularly through its hardware and software solutions that facilitate deep learning. The company’s GPUs are renowned for their effectiveness in training complex AI models, making them a staple in the industry. As the CEO pointed out, Nvidia’s innovations are not just about enhancing computational power but also about making AI more accessible.

Moreover, Nvidia is actively involved in developing frameworks and tools that simplify the deployment of AI solutions across various sectors. By democratizing access to AI technology, Nvidia aims to eliminate some of the barriers that have led to misconceptions in the first place.

Conclusion: A Call for Informed Optimism

The Nvidia CEO’s challenge to prevailing misconceptions about AI, particularly in light of the DeepSeek sell-off, serves as a crucial reminder of the importance of understanding the technology’s complexities. As the AI landscape continues to evolve, investors and stakeholders must embrace a more informed and optimistic perspective.

By shifting the focus from short-term fluctuations to long-term potential, the industry can cultivate a healthier investment environment. Nvidia’s commitment to innovation and education will undoubtedly play a transformative role in shaping the future of AI technology, making it essential for investors to stay engaged and informed.

In summary, the AI sector is ripe with opportunities, but navigating its complexities requires a nuanced understanding. As we look ahead, let’s keep the conversation going, challenge misconceptions, and invest wisely in the potential that AI holds for the future.

See more Future Tech Daily