Why Strong Earnings Fail to Impress Wall Street’s Chipmakers

In the ever-evolving landscape of technology, chipmakers have often been perceived as the backbone of innovation. With their integral role in powering everything from smartphones to advanced AI systems, one would assume that robust earnings reports would lead to soaring stock prices. However, a puzzling trend has emerged: despite reporting strong earnings, many chipmakers are failing to impress Wall Street. This article delves into the factors contributing to this dissonance and explores what it means for the broader tech sector.

Understanding Wall Street’s Skepticism

Wall Street’s skepticism towards chipmakers, even in the face of impressive earnings, can be attributed to several key factors:

- Market Saturation: The semiconductor industry has seen unprecedented growth over the past few years, driven by the demand for smartphones, laptops, and data centers. However, as these markets mature, the potential for explosive growth diminishes. Investors are increasingly wary of companies that fail to demonstrate clear pathways for future growth.

- Supply Chain Challenges: The global semiconductor shortage highlighted vulnerabilities in supply chains. While many chipmakers reported strong earnings due to high prices and demand, Wall Street remains cautious about their ability to navigate ongoing supply chain disruptions.

- Technological Advancements: Rapid advancements in technology mean that chipmakers must continually innovate. Investors are looking for companies that not only excel today but also have a roadmap for future technologies. Failing to keep pace with competitors can lead to a loss of investor confidence.

- Macroeconomic Uncertainties: Factors such as inflation, interest rates, and geopolitical tensions can impact investor sentiment. Even with strong earnings, fears about a potential recession can overshadow positive financial results.

The Earnings Report Paradox

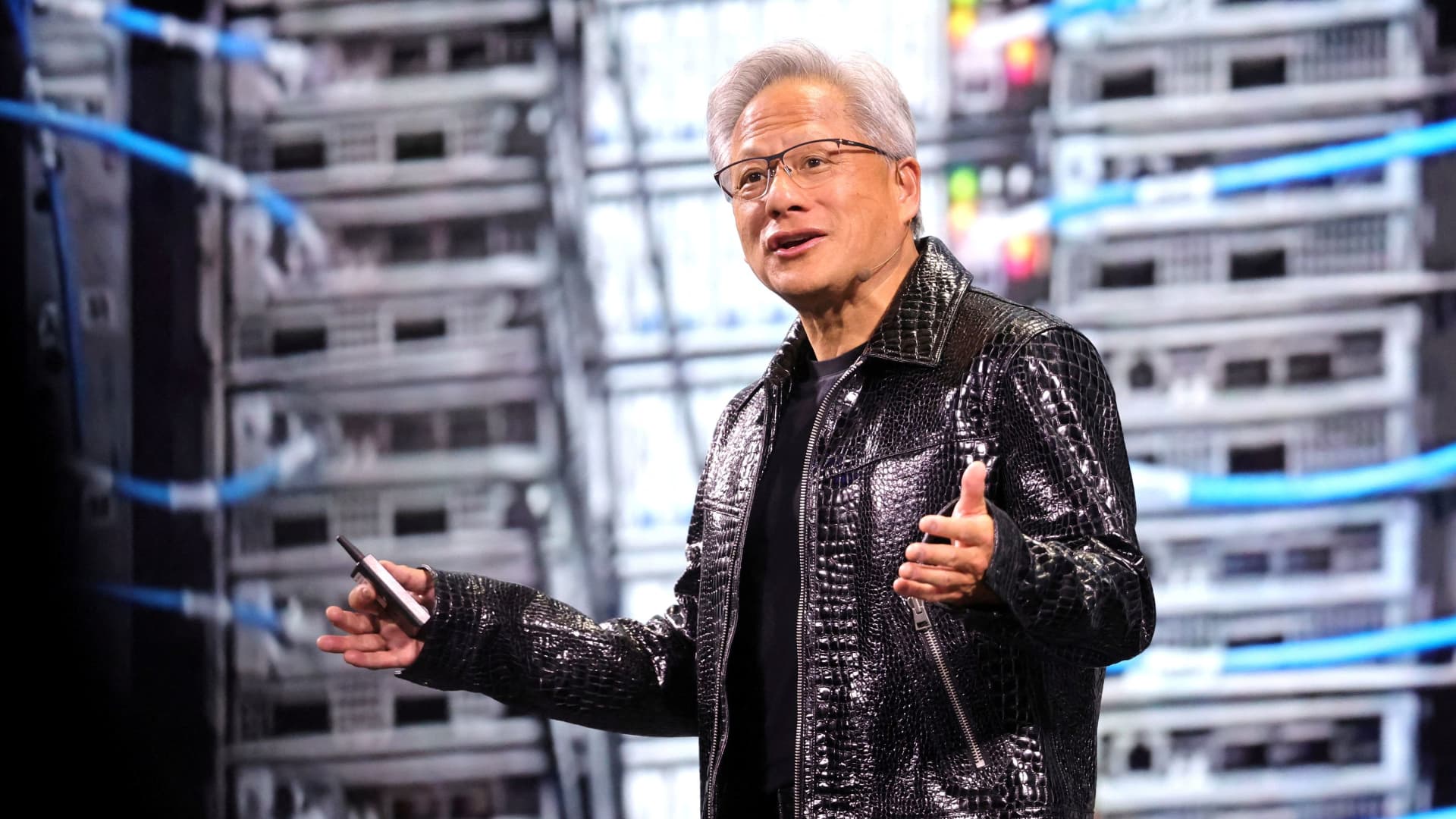

One of the most intriguing aspects of the current situation is the earnings report paradox. Chipmakers like NVIDIA and AMD have recently posted stellar earnings, often exceeding analysts’ expectations. However, their stock prices have not necessarily followed suit. This raises the question: why is Wall Street so slow to react positively to strong earnings?

To understand this paradox, it’s essential to look at how Wall Street evaluates companies. The tech sector is often driven by expectations of future growth rather than just current performance. As a result, if investors feel that a company’s future growth prospects are limited, they may choose to sell their shares even after a strong earnings report.

Future Growth Prospects: The Key to Investor Confidence

For chipmakers, demonstrating a clear path to future growth is crucial. Investors are increasingly looking for companies that can adapt to changing market conditions and technological advancements. Here are some strategies that chipmakers can employ to bolster investor confidence:

- Investing in R&D: Continuous innovation is vital in the semiconductor industry. Companies that prioritize research and development may find themselves better positioned to capture emerging markets and technologies.

- Diversifying Product Lines: Chipmakers that can diversify their offerings beyond traditional markets may find new revenue streams. For instance, expanding into automotive chips or IoT devices can provide additional growth opportunities.

- Strengthening Supply Chains: Addressing supply chain vulnerabilities is crucial. Companies that can demonstrate resilience and adaptability in their supply chains are more likely to instill confidence in investors.

- Strategic Partnerships: Collaborating with other technology firms or entering joint ventures can enhance a chipmaker’s market presence and technology capabilities.

Investor Sentiment and Market Dynamics

Investor sentiment plays a pivotal role in the performance of chipmakers. Stock prices are often influenced by broader market dynamics, including the performance of major indices, interest rates, and even social media buzz. In today’s digital age, news spreads rapidly, and sentiment can shift overnight.

Moreover, the tech sector is characterized by a unique phenomenon known as “fear of missing out” (FOMO). Investors often chase high-growth stocks, leading to inflated valuations, while simultaneously avoiding stocks perceived as stagnant, regardless of their current earnings performance. This creates a challenging environment for chipmakers that may have solid fundamentals but lack the excitement that drives stock prices higher.

The Road Ahead for Chipmakers

Despite the current challenges, the future for chipmakers is not all doom and gloom. Here are some promising trends that could reshape the landscape:

- AI and Machine Learning: The growing demand for AI and machine learning applications is driving the need for advanced chips. Companies that can develop specialized processors for these applications are likely to see substantial growth.

- 5G Technology: With the rollout of 5G networks, there is a burgeoning demand for chips that can support faster data transmission and connectivity. Chipmakers that invest in 5G technology could benefit significantly.

- Sustainability Initiatives: As environmental concerns grow, chipmakers that prioritize sustainable practices may attract socially conscious investors, enhancing their market appeal.

Conclusion: A Call for Adaptation and Resilience

In conclusion, the dissonance between strong earnings and Wall Street’s skepticism towards chipmakers underscores the complexities of the tech sector. While robust financial performance is essential, it is no longer sufficient on its own to impress investors. Chipmakers must focus on demonstrating their ability to innovate, adapt, and thrive in a rapidly changing market landscape.

As the tech industry continues to evolve, chipmakers that embrace change and prioritize future growth will ultimately emerge as leaders. By addressing the challenges of today while keeping an eye on tomorrow, these companies can navigate the uncertainties of Wall Street and secure their place in a competitive market.

See more Future Tech Daily